Compound interest calculator for lump sum

Making a lump-sum payment can help you save money pay off your loan quicker or even lower your monthly mortgage payment. In short the power of compounding calculator shows the maturity value of a lump sum investment at the end of a specified period at a specific rate of return.

Simple Interest Vs Compound Interest Top 8 Differences To Learn Simple Interest Compound Interest Maths Solutions

Youll find this extremely useful when trying to project what your assets may be worth in the future.

. Calculator For Compound Interest Formula. Find out if its the right choice for you. Subtract the initial balance if you want to know the total interest earned.

Put Inputs Here. The above calculator compounds interest monthly after each deposit is made. Let us take the example of David who has decided to deposit a lump sum amount of 1000 in the bank for 5 years.

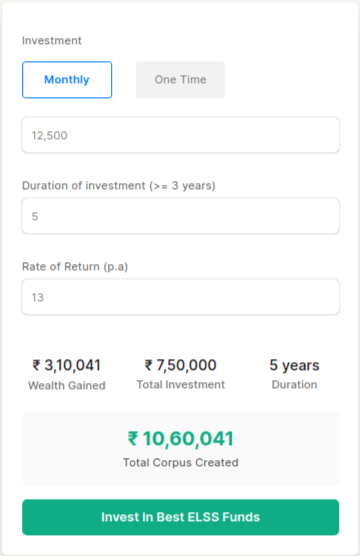

The compound interest calculator gives the total investment wealth gained and maturity value both in number and in graphical format. NPS Calculator enables you to decide your monthly contribution towards NPS accordingly. When you have extra payments in hand you either choose to schedule extra payments in a lump sum or at regular intervals in the loan schedule.

It is a compound interest formula with one of the variables being the number of times the interest is compounded in a year. To calculate compound interest we use this formula. This is a compound interest calculator savers can use to get an idea of how.

I represents the rate of interest earned each period. The power of compound interest means you earn interest on interest. A P 1 rn nt.

The above calculator compounds interest yearly after each deposit is made. FV represents the future value of the investment. Most DB plans offer the option of a one-time lump sum payment or monthly benefit payouts.

Plus it allows you to add monthly contributions. PV represents the present value of the investment. Considering the above example where Mr.

Use the interest rate at which the present amount will grow. There is also an option to set a repayment term which will then calculate the associated monthly payments needed to satisfy the judgment over that loan term in years. Years Percent Yield Initial Balance Monthly Contribution Results.

By wiping out a big chunk of principal your total interest savings will skyrocket because of the compound effect. Savings Calculator This one takes a lump sum of money and compounds it monthly over a fixed period of time at a fixed annual yield. Answer the question How much would I like to have saved up by a certain time in my life Enter the dollar amount as the future lump sum.

All in One Financial. Compound interest formulas are the interest rate you earn on your money during a compounding period in a savings account at a financial institution or insurance company. Its designed so that you can enter one single initial sum or a single initial sum following by regular monthly payments or regular monthly payments with no initial investment.

Adjust the lump sum payment regular contribution figures term and annual interest rate. 11 instead of 11. Savings calculator Work out how a lump sum or regular monthly savings.

Payments Due Over Time. Now he has recently learned about the effect of compounding on the final amount at the time of maturity and seeks to calculate the same for his deposited sum. Here A estimated returns.

Compound interest is calculated using the compound interest formula. If one lump sum payment was made then enter the amount in the average payment field and enter 1 in the number of payments. Enter it as a percentage value ie.

As the name suggests a PI loan has repayments which include both principal the amount owing on a loan and interest the borrowing cost of the loaned funds accrued. It perfectly demonstrates how regular or early savings combines with the miracle of compound interest to make money grow. If the balance will be paid in.

Sometimes the weekly payments compound interest on a daily basis offering a weekly payment option for the borrowers convenience. When theres compound interest it means that the money you earn each year is added to the money you already have. Compound interest can make a large sum grow even more significant over time.

Arun wants to invest a lump sum amount of Rs 1 lakh he has a couple of investment options in place like fixed deposit debt mutual fund PPF. To calculate your future value multiply your initial balance by one plus the annual interest rate raised to the power of the number of compound periods. A PI also known as P and I or Principal and Interest is the most common type of loan repayment structure.

P Present value. He can use Scripboxs fixed deposit interest calculator along with a debt mutual fund calculator and PPF calculator. If you are getting 51 million annually and are paying taxes every year you may end up with less money than if you took the lump sum.

The sooner you put a lump sum repayment toward your principal the better. FV PV x 1 in where. When you invest 400 million it has the potential to grow to over 1 billion in the number of years you would receive annuity payments.

National Pension Scheme NPS Calculator helps you to know the monthly pension and lump sum amount that you may get at the time of retirement. If you start with 25000 in a savings account earning a 7 interest rate compounded monthly and make 500 deposits on a monthly basis after 15 years your savings account will have grown to 230629-- of which 115000 is the total of your beginning balance plus deposits and 115629 is the total interest earnings. Lumpsum calculators use a specific formula to compute the estimated returns on investments.

N represents the number of periods. Deposits are made at the beginning of each year. For example If Mr.

Lumpsum Calculator Formula to calculate mutual fund returns. Making a lump sum or several lump sum payments will decrease the amount of time youll carry your debt dramatically. How to calculate compound interest.

If you initially had 5000 saved up and wanted to deposit 1000 at the beginning of the second year then you would set the initial deposit amount to 4000 as the other 1000 would automatically be added at the. But there are some who offer compound interest weekly. In the context of pensions the former is sometimes called the commuted value which is the present value of a future series of cash flows required to fulfill a pension obligation.

So instead of just growing the. The compound interest equation basically adds 1 to the interest rate raises this sum to the total number of compound periods and multiplies the result by the principal amount. Use the compound interest calculator to see the effects of compounding and interest rates on a savings plan.

Compound Interest Calculator Best Savings Accounts Best CD Rates Best Banks for Checking Accounts Best Personal Loans Best Car Loans More. Present Value Discount Rate. How do you calculate a PI loan.

A Compound Interest calculator is used to calculate the projection for compound growth for your savings account.

Compound Interest Calculator Daily Monthly Quarterly Annual

Time Value Of Money Cheat Sheet By Nataliemoore Download Free From Cheatography Cheatography Com Cheat Sheets For Every Occasion

Compound Interest And Present Value Principlesofaccounting Com

11 3 Explain The Time Value Of Money And Calculate Present And Future Values Of Lump Sums And Annuities Business Libretexts

Number Of Periods Archives Double Entry Bookkeeping

Future Value Annuity Payment Calculator To Achieve Savings Goal

Compound Interest Calculator Daily Monthly Quarterly Annual

What Is A Lumpsum Calculator Ubuntu Manual

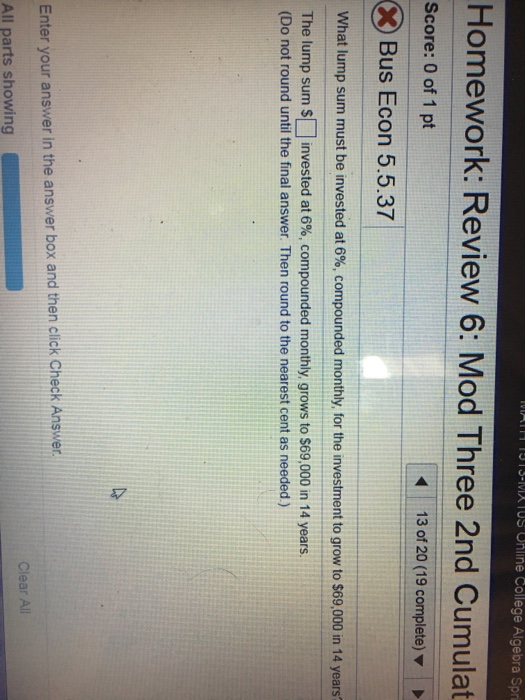

Solved What Lump Sum Must Be Invested At 6 Compounded Chegg Com

Elss Investments Calculator Calculate Elss Tax Saving Mutual Funds Returns

Extra Payment Calculator Is It The Right Thing To Do

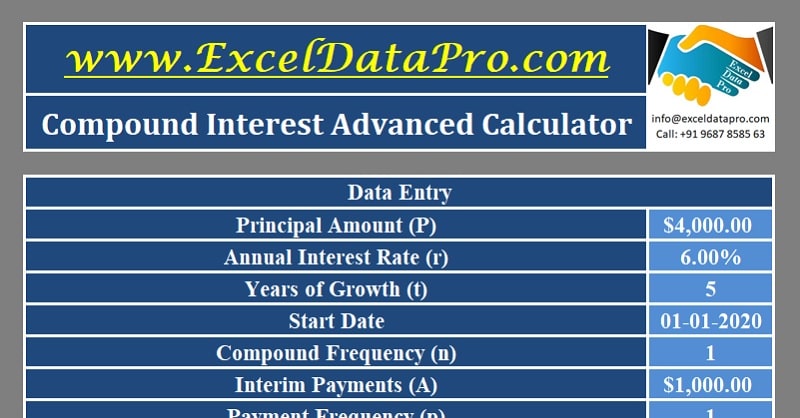

Download Compound Interest Calculator Excel Template Exceldatapro

Compound Interest Calculator Daily Monthly Quarterly Annual

How To Calculate Future Value Of Simple Ordinary Annuity If There Is A Present Value Quora

Compound Interest Calculator Daily Monthly Quarterly Annual

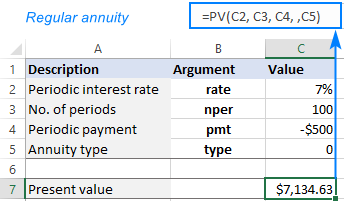

Using Pv Function In Excel To Calculate Present Value

Compound Interest Calculator Calculate Compound Interest Max Life Insurance